As an Independent Financial Advisor, you're well aware of how important it is to stay up to date and knowledgeable on any changes to the retirement and tax planning industry. Below are a few of key adjustments to note for 2022’s income taxes, retirement planning, investments, education credits, estate planning, and more. Keep these numbers in mind to help with future appointments!

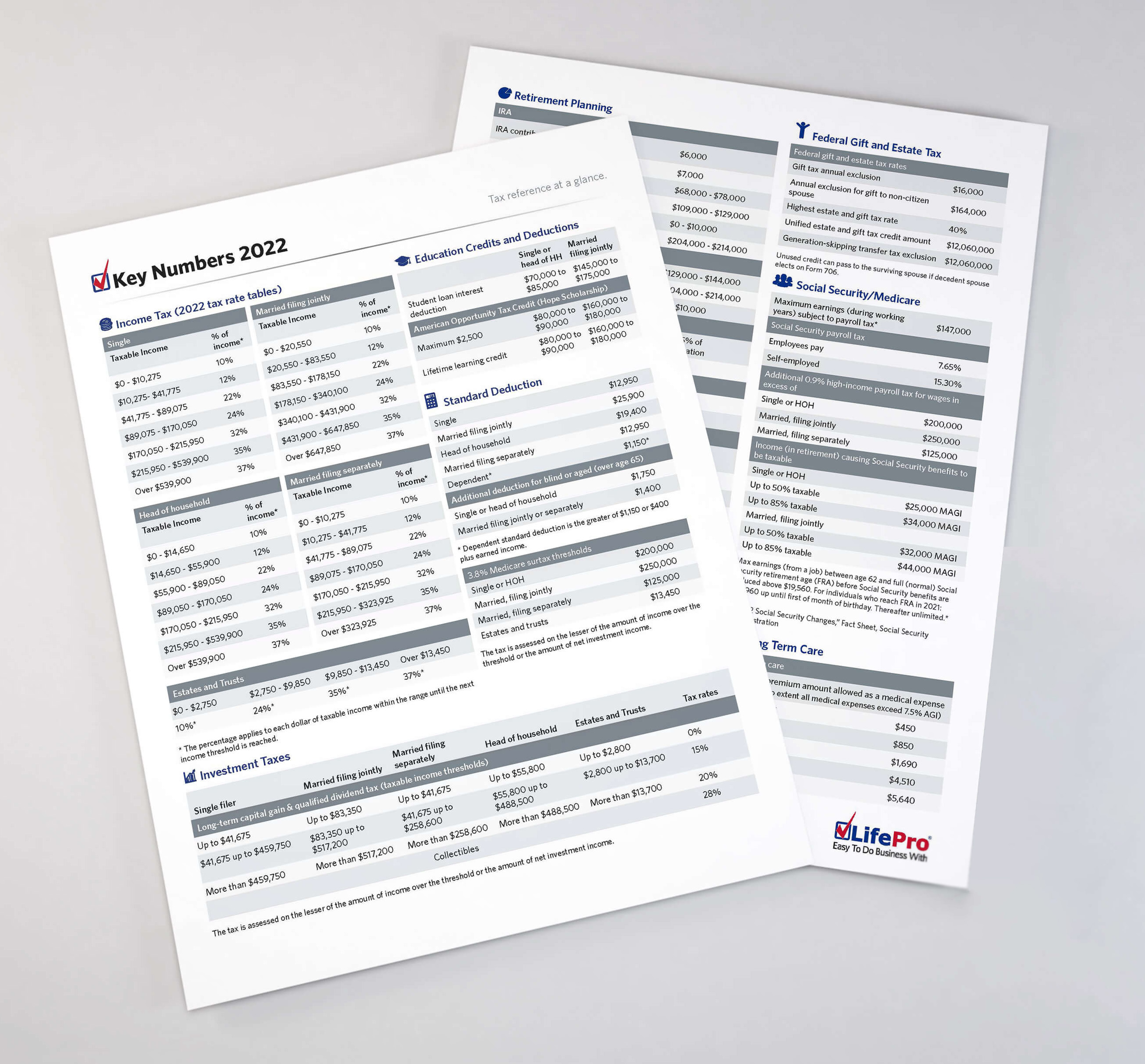

Key Numbers 2022

Click the image below to download the official document. Print it out and keep it for your reference!

If you need any additional sales tactics on how to educate your clients on the best tax strategy for them, contact your Field Support Representative (FSR) today by phone at (888) 543-3776.

The information provided herein should not be interpreted as legal, accounting or tax advice.